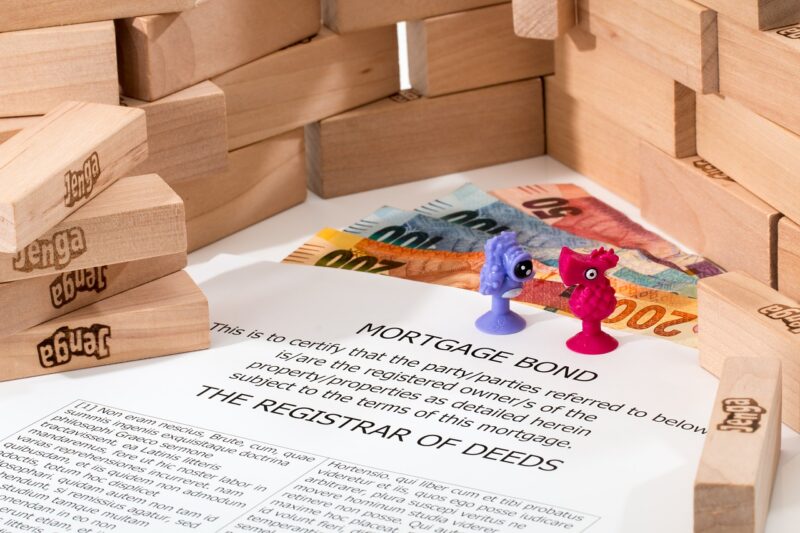

Considering the immense growth of the real estate sector, it is quite evident how individuals are investing more on housing properties and land. The overall growth of this sector is fuelled by various factors like rising needs of common individuals, improved disposable income, etc. However, in order to handle the present economic condition, borrowers are also opting for secured loans like loan against property(Mortgage Loan) to support themselves financially.There are professionals at Altrua Financial that can help you with mortgage of any kind.

Key aspects that influence loan approval

Pledging your property as collateral allows you to obtain a handsome amount, which you can invest to meet certain financial requirements. Here is a list of key factors that you should keep in mind before opting for a loan against property.

Credit score

From your previous debt history to your repayment track record, every aspect is evaluated by the lending institutions once you apply to attain a sizable amount from them. Based on your credit score, it becomes easier to sanction your mortgage loan request and offer a flexible repayment tenor to keep up with the monthly instalments.

Most borrowers are unaware of how their credit score affect loan against property eligibility, which basically leads to poor repayment track record. Make sure the CIBIL score is near 750 or above in order to get fast approval from the lender along with attractive interest rates.

LTV or loan to value

Loan to value refers to the portion of a mortgaged property’s price, which a financial institution is ready to disburse as a loan against property. Generally, the loan to value ratio for a LAP is restricted between 75% and 90% of the specific property’s market valuation. The exact amount available to you as loan depends on several factors, such as eligibility criteria, property location, amenities available, etc.

Your LTV also determines the loan against property interest rates and total interest outgo. Thus, make sure to compare the highest LTV from your chosen lending institution.

Loan tenor

A loan against property is considered as a long-term commitment that becomes challenging to handle after a point with immoderate interest rates. Make sure to choose the loan tenor carefully as it involves paying a specific amount each month.

Due to its secured nature, this particular loan variant inevitably comes with more flexibility and attractive schemes.While opting for a shorter tenor, you can easily get rid of that financial burden and make your emergency financial requirements as well.

Pre-approved offers

In case you are looking for better loan terms, you can consider pre-approved offers provided by different lending institutions. Since these offers are available on different financial products like home loan, loan against property, etc., getting a decent deal is not that difficult anymore.

Before mortgaging a property, it is wise to look for factors that usually induce effects in the sanctioning process. The aforementioned discussions are based on that to help the salaried individuals to stay prepared for the notable aspects of LAP loans.