The house price to income ratio in Australia is 108.6. At the same time, the construction industry is booming, with about 1.18 workers. In 2020, the country saw an addition of A $133 billion in the industry’s gross value. These statistics should make you consider property development in Australia as an investment opportunity. Here’s what you need to know before you begin exploring properties in Australia for investment.

Budget

With the average cost of houses ranging from about A $450,000 to over A $1 million, it is best, to begin with, a budget. Depending on your budget, you can pick a location, size, and property type for investing. Having a set price in mind can help you narrow down your search significantly in an otherwise vast market.

Cost

How much a property is worth when you purchase it makes all the difference in your ROI. Costs vary from place to place, with Sydney, Melbourne, and Canberra being the most expensive. Therefore, it is worthwhile considering investing in the suburbs surrounding upcoming neighbourhoods.

Investment Horizon

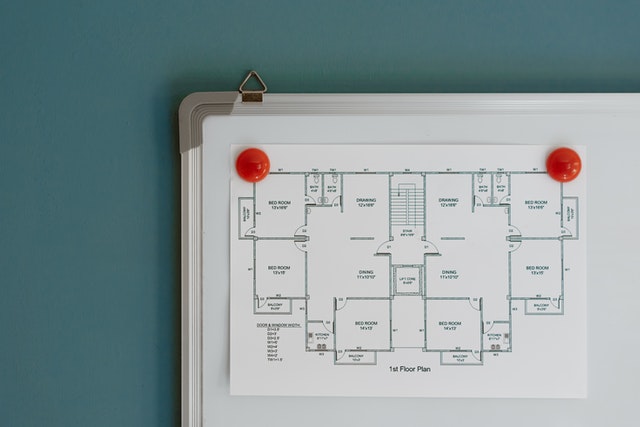

You can invest in greenfield or capital renovation projects. The former is a development from the ground up, while the latter are cosmetic projects. Greenfield projects take time to get permits, source materials, and manpower before kick-off. Such an investment, while it may appear cheaper, will require you to be patient unless you can find a “shovel ready” one with everything in place.

If patience is something you lack, you can invest in capital renovations, which are slightly more costly but give quicker returns. A greenfield project may necessitate a significant time investment, whereas a renovation does not.

Rent Or Sell

Another aspect to consider when investing in property development is whether you are looking for a steady stream of income or want your entire investment plus profits in one shot. These factors will help you decide if you wish to rent out the property or sell it once completed. Based on this decision, your investment amount and time can change considerably.

Anticipating Delays

No matter how committed your contractor is, there are bound to be unexpected delays. These delays may throw your schedule off track. You must ensure that you anticipate and account for these delays in your decision.

Another factor to consider is market forces. There may be macroeconomic factors that delay the sale of your property. For example, COVID caused a lot of people to lose jobs or settle for lower salaries. Due to this, the housing market saw a drastic fall in demand and prices were reported to have contracted by about 3%.

Government Policies

Various local and federal policies can impact the housing market. In 2020, the government reduced interest rates to alleviate the declining demand. Similarly, when there is an unprecedented surge in demand, they can intervene by increasing interest rates. It is important to factor such events into your investment decisions.

The sector of property development in Australia has recovered quite well since it experienced COVID lows. Government stimulus and economic recovery have led to increased demand and supply, keeping pace with new projects being approved regularly. Keeping the points mentioned above in mind can help you make a prudent buying decision.